The fluctuation of the US dollar in a narrow range slanted toward decline during the Asian session, to witness its bounce to the seventh session in thirteen sessions from the top since March 27 against the Japanese yen amid the scarcity of economic data by the Japanese economy and on the cusp of developments and economic data expected today Wednesday by The American economy is the largest economy in the world.

At exactly 05:59 am GMT, the US dollar pair fell against the Japanese yen by 0.19% to 107.59 levels compared to the opening levels at 107.80 after the pair achieved its lowest level during the trading session at 107.56, while it achieved its highest at 107.87.

Investors are currently awaiting by the US economy the release of the house price index, which may explain the acceleration of growth to 0.4% compared to 0.3% last January, and that comes hours after the Senate announced the agreement of the two poles of the American Republican Party and the Democratic Party on A program to support small businesses facing the consequences of the $ 484 billion outbreak of the Coronavirus.

It is reported that US President Trump recently announced his administration’s plan to gradually restart and operate the American economy, indicating that the global medical crisis may subside later, while its economic consequences remain, and according to the latest figures issued by the World Health Organization, the number of cases infected with Coronavirus has increased to More than 2.4 million people were killed, 163,097 people in 213 countries.

In another context, the markets are still assessing the catastrophe of the oil markets and the sharp fluctuations in the global energy markets in addition to other indications that global companies and banks are making difficult to provide expectations in the shadows of the global closure due to the spread of the Coronavirus globally, and we would like to point out because the collapse of the oil markets indicates that The blow to the global economy will be much worse than what investors who were risk-averse predicted.

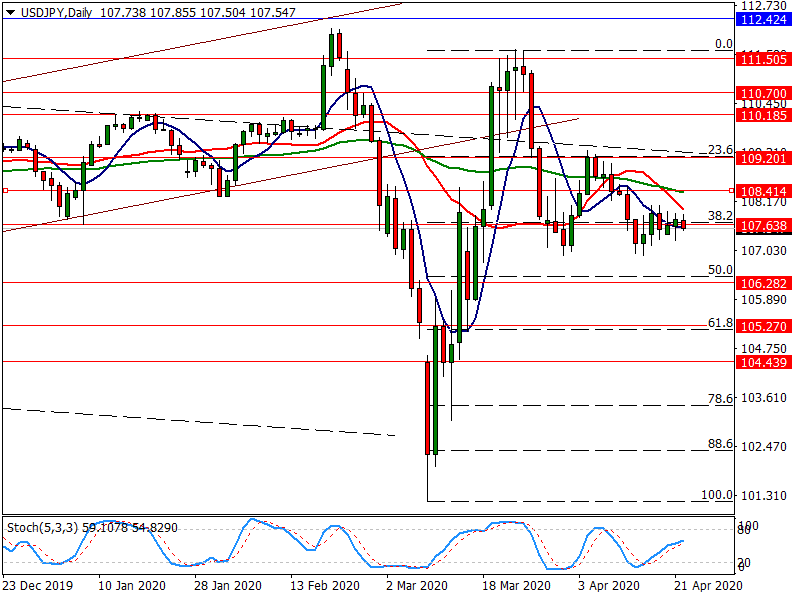

The dollar versus yen pair is back to fluctuate around the 107.68 level, and we notice that the stochastic indicator significantly loses its positive momentum to approach the overbought areas, to form a negative incentive that we expect to contribute to pushing the price down again, where our next negative target is located at 106.44.

Therefore, we believe that opportunities are open for the upcoming sessions, noting that consolidation above 107.68 will stop the suggested bearish bias and push the price for gains that start at 108.40 and extend to 109.22.

The expected trading range for today is between 106.80 support and 108.20 resistance.

Expected trend for today: bearish.